Milo in the Crosshairs

Jan 03, 2025

By Lindy McMillen, Director of Grain Trading

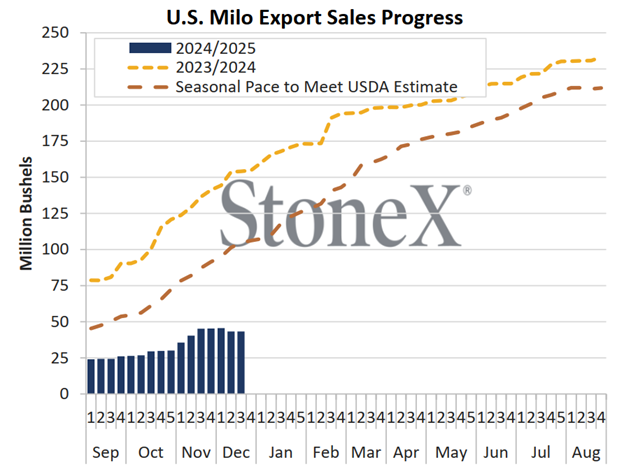

Poor milo demand has really put the pressure on the local milo market. China is overwhelmingly the world’s largest milo importer – accounting for almost 88% of global imports – and they have largely remained on the sidelines for U.S.-grown milo as they wait to see what tariffs will look like under a Trump administration. Export sales as of 12/19/24 are 61.5 million bushels, or 28%, below the seasonal pace needed to hit the current USDA 2024/25 export estimate of 220 million bushels. This was already a 19 million bushel decrease from the 2023/24 marketing year. For context, current USDA estimates are that over 2/3 of all U.S. milo will be for exports. If there is any type of Chinese export program, and that’s a very big “if”, it will likely be February forward – when the trade settles into markets under a new White House. With export demand non-existent, our local crop is having to find its way into ethanol and feed markets, which seem to be flooded with bushels for the near future. A lower sellable market has meant lower posted elevator bids in the area. One bright spot for milo is that corn futures have seen nice gains in the last month, so cash prices have remained steady despite a weaker basis.For more information, reach out to a member of the GCC Grain Team. We would love to talk about grain marketing options that could be a good fit for your operation.